Which Of The Following Is Not A Way That A Firm Can Increase Itsã¢â‚¬â€¹ Dividend

i. Introduction

A dividend is a distribution of profits by a corporation to its shareholders. When a corporation earns a profit or surplus, information technology is able to pay a proportion of the turn a profit as a dividend to shareholders. The remaining profit afterward dividend, namely retained earnings will exist used to re-invest in the hereafter.

A high dividend payment ways that the visitor is reinvesting less money back into its business organisation. Co-ordinate to Khan et al. (2019) companies with high dividend tend to attract investors who prefer the assurance of a steady stream of income to a high potential for growth in the share price. On the opposite, companies with depression dividend payment means that the companies is reinvesting in business growth, so that the higher future upper-case letter gains for investors.

Studies on the impact of the dividend policy on the financial performance of enterprises take been carried out past many scholars around the world. Some scholars believed that this topic is one of the well-nigh challenging research issues (Onanjiri and Korankye 2022; Frankfurter and Wood 2002; Amidu 2007). Some others think that dividend policy is not merely business transaction, but it is business firm's strategy practical to distribute income to shareholders (for example, Gill et al. 2010).

Regardless of various research, the previous studies take evidenced the differences about the impact of dividend policy on a firm's fiscal operation. Some scholars believed that dividend policy significantly and positively impact on financial performance (for instance, Ali et al. 2022). Some others reported that dividend policy impact significantly simply negatively to firm performance (Onanjiri and Korankye 2022). The differences in research result are not merely between research years just also inconsistent across countries (Glen et al. 1995; Kim and Kim 2022), and even among economical sectors in a specific country (Khan et al. 2022).

This newspaper is motivated by occurrence of unlike research results. Information technology aims to find the furnishings of dividend policy (represented by dividend rate and determination of dividend payment) on house'south fiscal performance. Findings from this could contribute to literature by confirming the previous research. Moreover, it could help firms' managers in setting dividend policies for listed firms through which could command their cashflow and financial performance.

The paper has the following parts: the side by side section is the analysis of the literature review and theoretical framework, followed by the enquiry methodology, empirical findings, discussions and recommendations, and concluding remarks.

2. Literature Review and Theoretical Framework

Firms' management always concerns nigh whether to pay dividends to shareholders or to retain them for future re-investments and what percentage should be applied if dividend payments are fabricated. The firms' managers need to align shareholders, insiders, and outsiders with each other.

The theoretical principle underlying the effect of dividend policy on a firm'southward performance can be described in dividend relevance theory stated past Miller and Modigliani (1961). They theorized that dividend policy has no affect on stock toll and cost of capital, resultantly the dividend policy of a firm is irrelevant for shareholders' wealth in keeping with perfect capital market assumptions. Miller and Modigliani (1961) revealed a well-designed assay of the relationship between dividend policy, growth, and share valuation. Based on well-defined but a simplified fix of perfect capital market assumptions, Miller and Modigliani (1961) expressed a dividend irrelevance theorem. According to this concept, investors do not pay any importance to the dividend history of a visitor and thus, dividends are irrelevant in calculating the valuation of a company. Due to the distribution of dividends, the price of the stock decreases and will nullify the gain made by the investors because of the dividends.

Litzenberger and Ramaswamy (1982) showed that dividend policy influences investor behaviors as a result of disparity in tax on dividends and capital gains. The authors believed that investors prefer depression-dividend businesses since the corporeality of taxes payable is minimized. Jensen and Meckling (1976) stated that there is a tradeoff in the form of bureau costs between having more or less insider ownership. Agency costs are created whenever the manager likewise controls an outsider'due south investment too her ain, considering there is a key conflict of interest.

The adjacent underlying theory is the pecking order theory which was first introduced past Donaldson (1961) and modified past Myers and Majluf (1984). The Pecking Order Theory relates to a company's uppercase structure. The theory states that managers follow a bureaucracy when considering sources of financing. The pecking order theory arises from the concept of asymmetric data which causes an imbalance in transaction power. Company managers typically possess more information regarding the company'due south operation, prospects, risks, and future outlook than external users such equally creditors (debt holders) and investors (shareholders). Therefore, to compensate for information disproportion, external information users need a higher return to counter the gamble that they are taking. As opposed to external financing, internal financing is the cheapest and nearly user-friendly source of financing.

Another underlying theory for dividend policies is the signaling theory that was firstly introduced by Spence (1973) and it is useful for describing behavior when two parties (individuals or organizations) have admission to unlike data sources as sender or receiver and both parties act differently. Dividend signaling is a theory that suggests that company announcements of dividend increases are an indication of positive time to come results. Increases in a company's dividend payout by and large forecast a positive future functioning of the company's stock. In the finance expanse, the reporting principle shows that the shift in dividends volition give shareholders an indication of the future profitability of the business organization and perceptions of management. Management will non increase dividends unless information technology is sure that future earnings will encounter the dividend increment. The pass up in dividend payout is considered a negative point considering investors will recall that the company's future earnings are going to decrease (Miller 1980).

Amidu (2007) examined whether dividend policy influences firm performance in Ghana. The analyses are performed using data derived from the fiscal statements of listed firms on the Ghana Stock Exchange (GSE) during the recent eight-year period. The results showed positive relationships between return on assets, dividend policy, and growth in sales. Surprisingly, the study reveals that bigger firms on the GSE perform less with respect to return on assets. The results also revealed negative associations between render on assets and dividend payout ratio. The results of the report generally supported previous empirical studies (see, for example, Michaely and Allen 2002; Gordon 1963; Bhattacharya 1979; Shefrin and Statman 1984; Easterbrook 1984; Amidu and Abor 2006; Danila et al. 2022).

Murekefu and Ouma (2012) sought to constitute the relationship between dividend policy with dividend payout as representative variable and firm performance amidst listed firms in the Nairobi Securities Commutation. The findings indicated that dividend payout was a major factor significantly positive affecting firm performance. It can be concluded, that dividend policy is relevant and that managers should devote adequate time in designing a dividend policy that volition enhance firm functioning and therefore shareholder value.

Likewise using dividend payout variable, Onanjiri and Korankye (2014) ascertained the impact of dividend policy on the fiscal performance of manufacturing firms that are trading on the Ghana Stock Exchange. The regression results reveal that dividend payout significantly negative impacts firms' financial performance. For the control variables, size and leverage were inversely related to performance while sales growth positively correlated with performance. Except for size, all the control variables were found to be statistically pregnant. Intuitively, quoted manufacturing firms in Republic of ghana which are interested in accentuating their return on assets may have to rationalize the quantum of dividend payout. This volition aid them accumulate loftier retained earnings to buttress investment in positive net present value projects which will fuel sales growth and thereby lessen their dependence on expensive debt finance in Ghana.

With the same vein of inquiry, Velnampy et al. (2014) attempted to discover out the relationship between dividend policy and firm operation of listed manufacturing companies in Sri Lanka. A set up of listed manufacturing companies was investigated. Returns on disinterestedness and return on avails were used as the determinants of house performance whereas dividend payout and earnings per share were used every bit the measures of dividend policy. The study found that determinants of dividend policy are not correlated to the firm performance measures of the organization.

Using dividend payment as contained variable for the model testing the influence of dividend on financial performance of 172 firms in Istanbul Stock Exchange, Dogan and Topal (2014) showed that dividend payments had influence on companies' performances, but in different ways for accounting-based indicators (ROA, ROE) and for market-based one (Tobin'due south Q).

Vijayakumaran and Atchyuthan (2017) empirically examined the relationship betwixt cash holdings and corporate operation using a sample of firms listed on the Colombo Stock Substitution over the catamenia 2022–2015. Controlling for unobserved heterogeneity and other firm characteristics, this written report establish that greenbacks holdings are positively related to firm performance. Ali et al. (2015) attempted to notice out the impact of dividend policy on firm performance nether high or low debt for all the non-financial sector companies listed on the Karachi Stock Exchange. They utilized the secondary information published past the Land Bank of Pakistan in the shape of balance sail analysis of the non-financial sector from 2006 to 2022 with the sample size consisting of 122 companies. They mainly focused on using 2 operation measures i.due east., Tobin's Q and Render on Equity both as dependent variables while the control variable includes the firm size and growth with debt as the moderating variable. They constitute that the dividend payout ratio has a significant positive relationship with Tobin's Q and ROA when in that location is both less and high debt. Also, there is no moderating effect of debt on the human relationship between dividend payout ratio and firm performance of all the non-financial firms listed on the KSE.

Khan et al. (2016) conducted a similar study for some firms listed on the Islamic republic of pakistan Stock Exchange from 2010 to 2022. The OLS technique was applied and the enquiry results evidence that there is a positive relation betwixt render on avails, dividend policy, and auction growth. The results of the research are generally similar to those of Ali et al. (2015). Specifically, the results show that the dividend payout ratio and leverage have a significant negative relation with the render on equity.

M'rabet and Boujjat (2016) sought to examine the relationship betwixt dividend policies and financial performance of selected listed firms in Morocco. Ii models were developed in an attempt to provide a theoretical explanation on the birds-in-paw dividend relevance theory and the Miller and Modigliani's (1961) dividend irrelevance theory. The findings indicated that dividend policy is an of import cistron affecting firm performance. Their relationship was likewise significantly positive. This, therefore, showed that dividend policy was relevant. It can be ended, based on the findings of this research that dividend policy is relevant and that managers should devote adequate time in designing a dividend policy that will enhance firm functioning and therefore shareholder value.

In Vietnam, the dividend payment of many companies listed on the stock market place, without any strategic credits, is even so spontaneous. Regarding dividend payment, businesses would have different ways of dividend payout at unlike times. Businesses pay dividends more often with higher payout ratios in certain industries when the business operation is assisting. Proponents of dividends signal out that a high dividend payout is important for investors considering dividends provide certainty almost the company'south financial well-being. Nevertheless, the dividend may not be paid, fifty-fifty though businesses are profitable. If a company thinks that its own growth opportunities are improve by available investment opportunities elsewhere, it often keeps the profits and reinvests them into the business. When a company decides non to offering a dividend payment, it keeps more money for its ain operations. Instead of rewarding investors with a payment, it can invest in its operations or fund expansion in hopes of rewarding investors with more valuable shares of a stronger company. Research on this issue has been conducted, but the results are generally applicable to manufacturing companies (Tran et al. 2022).

In Vietnam circumstance, at that place have been few studies about the relationship between dividend policy and a house's functioning that report similar results. Tran et al. (2015) applied the previously accepted model with ROE, ROA, and Tobin'due south Q are dependent variables, and dividend payout ratio and decision of dividend payment (binary value) are independent variables. The information was collected from audited financial statements of listed firms from 2009–2013. The author report that the cash dividend payment has a significant impact on the firm'south functioning measured. Withal, the dividend payout ratio has negative impact on firms' financial performance. This research contributes significantly to literature, withal, this written report contained some drawbacks, such as (1) collected information during the financial distress catamenia of Vietnam; (2) small sample size; and (three) data for calculating yearly dividend payout is non e'er provided so that the independent variable is not truly reliable.

From the higher up, we can meet that the impact of dividend policy on a firm'south performance has been investigated by many scholars from both developed countries and developing countries. And the results are not consequent. Some authors believe that dividend affects a firm'southward operation significantly and positively, while others show the reversed results, and some scholars bespeak that at that place is no relationship between these two factors.

From theories and literature review there are two enquiry hypotheses proposed as following:

Hypotheses1(H1).

Dividend rate has negative impact on firms' financial performance.

Hypothesestwo(H2).

Determination of dividend payment has positive bear upon on firms' financial operation.

3. Research Methodology

three.1. Research Model

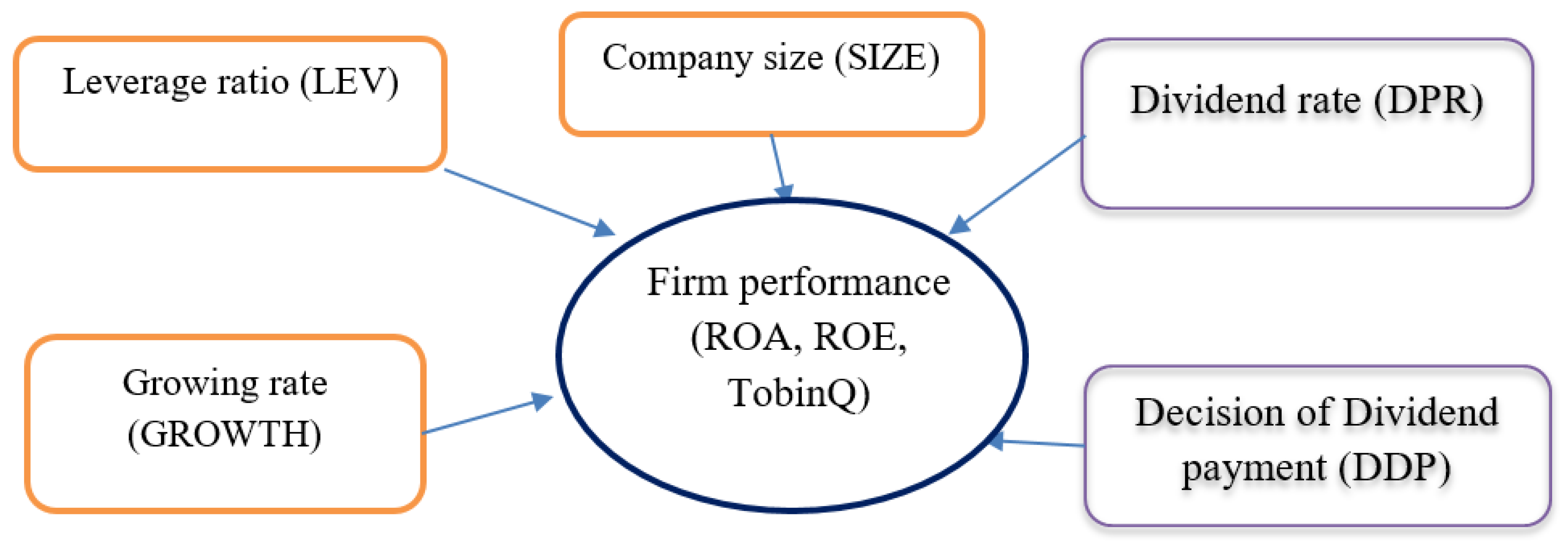

From the literature review of previous research models, nosotros institute that about of the studies have measured the impact of dividend policy on the firm's fiscal functioning. The following enquiry model (Figure 1) is built on Tobin's Q, ROA, and ROE equally a measurement of the firms' financial operation and five variables as independent variables. This mensurate is consistent with the studies of previous scholars such as Amidu (2007), Murekefu and Ouma (2012), and Velnampy et al. (2014), Dogan and Topal (2014), Tran et al. (2015), and Khan et al. (2016).

From the full general model, nosotros decomposed it into iii carve up models for each dependent variable, as follow:

- (1)

-

ROAit = β0 + β1DPRit + β2DDPit + βthreeSIZEit + β4LEVit + βvGROWTHit + εit

- (two)

-

ROEit = β0 + β1DPRit + β2DDPit + β3SIZEit + β4LEVit + βfiveGROWTHit + εinformation technology

- (iii)

-

TOBIN'SQit = β0 + β1DPRit + β2DDPinformation technology + β3SIZEit + βfourLEVit + β5GROWTHit + εit

where:

-

ROAit: Return on boilerplate total assets of the visitor i period t

-

ROEit: Render on average equity of company i period t.

-

TOBIN'S Qit: is a measure of business firm assets in relation to a business firm'south market value (the company i, period t). The formula for Tobin's Q is: Tobin's Q = Total Marketplace Value of Firm/Total Volume Value of Firm

-

DPRit: dividend rate (percent) of the visitor i menses t. DPR measured by the amount of dividend on par value of share.

-

DDPit: Decision of dividend payment of the visitor i period t. It takes value of 1 if house pays dividend, otherwise information technology gets zip.

-

SIZEit: Logarithm of total assets of the company i period t.

-

LEVit: Financial leverage of company i period t.

-

GROWTHinformation technology: Growth of revenue of company i period t.

iii.ii. Data Source and Data Drove

Equally mentioned above, the objective of the research is to investigate the event of dividend policy (measured by dividend rate, decision of dividend payment) on the firm'due south performance (ROA, ROE, and Tobin's Q are representative). Thus, we collect fiscal statements of firms listed on the stock market of Vietnam. We believe that this data source is highly credible because, under Vietnamese law, all listing firms are required to submit audited fiscal statements. And to overcome the drawback of the previous written report, we choose a longer time frame—from 2008 to 2022.

Up to the end of 2022, there are 745 firms listed on Vietnam's official stock exchange. All firms' fiscal statements from 2008 to 2022 are downloaded. Afterwards that, the data is arranged into a multi-column excel file so ratios for variables for each company in research sample are calculated.

Having estimated the ratios, we check the data and found out that several companies did non disembalm the dividend rate and/or decision of dividend payment. Besides, some of the listed companies accept a data span of less than 12 years. These companies are removed from the enquiry sample. At the end, merely 450 eligible firms to be selected for the research study.

According to Tabachnick and Fidell (1996), the sample size should be n = 50 + 8*1000 (where one thousand is the number of variables). Based on this, it is believed that the research sample is satisfied for running a statistical test or regression and research results may be applied to the whole population.

3.3. Data Processing Method

Due to the use of pooled data, we take to utilize the appropriate method of processing the data. Diverse statistical and econometric methods and techniques are applied step-by-step, equally follows:

First, information descriptions by min, max, median, mode, and standard deviation. This will provide some general features of the firms such as size, growth, leverage, greenbacks dividend per share, the proportion of earnings for the dividend. The statistical description also reports the variance between firms relating to each variable in the research model.

Second, a correlation exam is conducted to check the relationship between independent variables and dependent variables. If 2 contained variables are strongly correlated, reflecting a reasonably perfect value of correlation coefficient (effectually 1.0), the enquiry model may take a multicollinearity problem, in which case i independent variable must exist removed. Similarly, if the correlation coefficient between independent variables and the dependent variable is cypher, this means that there is no correlation between them. As a upshot, that independent variable is not suitable for the enquiry model.

3rd, multicollinearity trouble is tested. Multicollinearity exists whenever an independent variable is highly correlated with one or more of the other independent variables in a multiple regression equation. Multicollinearity is a problem because it undermines the statistical significance of an contained variable. It is advised that the VIF predictor should be calculated. If VIF is greater than v, information technology ways multicollinearity problem exists (Hoang and Chu 2022).

Quaternary, the F-test is used to choose the best fit model among OLS and FEM. If FEM is chosen, the Hausman test is conducted to cull betwixt FEM or REM.

Finally, beta for contained variables in the model is tested. Past doing this, the variables which take the greatest event on firms' performance could exist plant and whether the influence is positive or negative at a specific statistical significance level. The results of the tests are presented in the following section.

4. Empirical Findings

The statistical description in Table 1 indicates that the sample firms have an average ROE of 14 per cent, average ROA of around 7 per cent, and average Tobin'due south Q is only 0.61—the market value of listing firms is lower than to their book value. The low Tobin'south Q implies the pessimistic near the firms' future development.

For the dividend variables, the results signal that there are more than 60 per cent of sample firms paid dividend to shareholders (measured past DDP). However, the average dividend charge per unit for the sample firms is quite low, around 10.five per cent.

The second test conducted is the correlation betwixt variables and the result is reported in Table ii, equally follows.

The results from Tabular array two evidence that the dividend policy variables (measured by DPR and DDP), have a positive relationship to the firms' functioning measured past ROA, ROE, and Tobin Q. Conversely, leverage and house size (measured by logarithms of assets) take a negative correlation to firms' performance. The written report results besides show that the contained and dependent variables are correlated with each other, satisfying correlation weather, and no variable is removed from the enquiry model.

Nosotros also check for multicollinearity issues using the VIF indicator. The results reporting in Table 3 show that the VIF is smaller than 2, pregnant in that location no multicollinearity issues in our research model (Hoang and Chu 2022).

Autocorrelation is also tested by using Wooldridge exam in panel data. The test upshot is

F(1, 449) = 2.149; Prob > F = 0.1434

This examination effect implies that there is no series autocorrelation in the model.

Later on checking for correlation, autocorrelation, and multicollinearity problems, we proceed evaluating the appropriateness of the regression model for panel data. To do this, nosotros first conduct the Pooled OLS and Fixed outcome model (FEM). The results from F-test evidence that FEM is more appropriate than OLS. This leads to the test being performed to compare betwixt FEM and Random effect model (REM) past using the Hausman test, and nosotros found that the FEM is more than appropriate and chosen. The regression results are presented in the following Table 4.

The research model for ROA could be presented every bit the following equation:

ROAi,t = 0.346 + 0.0008DPR − 0.0085DDP − 0.0080SIZE − 0.0014LEV + 0.0002GROWTH + εit

First, the dividend rate (DPR) had a positive effect on ROA, statistically significant at 1% level. This effect indicates that a higher rate of dividend leads to a college return on full assets, only the influence level is very pocket-size. When the dividend rate increases past i percent, the ROA increases only 0.0008 pct. This result is similar to the study by Amidu (2007) only in contrast to the study by Khan et al. (2016), who evidenced that dividend rate is negatively correlated to ROA. This phenomenon may be explained by the fact that when companies increase dividend, they tin mobilize more capital for further development, and, equally a result, the profitability decreases.

2nd, decision of dividend payment (DDP) has negative effect on ROA, at statistical level of 1%. Information technology implies that the declaration of dividend affects to house's functioning in negative style.

Third, with regard to the controlling variables, both firms' nugget size (SIZE) and leverage (LEV) have a statistically negative effect on ROA. Still, the firms' sale growth (GROWTH) had a significantly positive affect on ROA.

Fourth, the regression results also evidence that the value of R-square = 0.2217, which means that the independent variables of the model explained 22.17% of the change of the dependent variable.

The research model for ROE could be presented as the following equation:

ROEi,t = 1.001 + 0.0015 * DPR − 0.0183 * DDP + 0.0004 * GROWTH − 0.0323 * SIZE + 0.0001 * LEV + ε

Kickoff, similarly as ROA, the DPR variable has a positive affect on ROE at a significance level of one% and the influence level is also small. Specifically, the increase of DPR by 1% leads to an increase of ROE by 0.010%.

Second, DDP has a negative impact on ROE at statistically pregnant level of i%. As same every bit ROA, firms' declaration of dividend impact reversely to firms' financial performance.

3rd, for controlling variables, the result shows that only sale growth and house size have statistically pregnant touch on on ROE in unlike ways, sale growth leads to higher performance but firm size results in lower performance. Surprisingly, the firms' leverage does not have meaning affect to ROE.

4th, the regression results also show the value of R-square = 0.0574, which indicates that the contained variables of the model explain just five.74% of the change of the dependent variable. At that place are many other factors affecting to return on equity.

For the Tobin's Q, the inquiry model could be presented as the following equation:

TOBIN'SQi,t = three.704 − 0.0021 * DPR + 0.0189 * DDP − 0.0001 * GROWTH − 0.0985 * SIZE − 0.0082 * LEV + ε

The research results betoken that:

Commencement, DPR negatively impacts Tobin's Q a statistically significance level of 1% with small magnitude. Information technology means that if the dividend rate increases by 1 percent, Tobin's Q volition decrease by 0.0021 per centum bespeak. The decision of dividend payment (DDP) also contributes to the increase of Tobin's Q, at a pregnant level of x%.

For decision-making variables, financial leverage, sales growth and size take negative touch on Tobin'south Q and they are all statistically significant.

For the appropriation of the model, the regression results likewise show that the value of R-square = 0.1364 which shows that the independent variables of the model could explain 13.52% of the change in Tobin'due south Q.

From the results of the above iii models, we could realize that both in book value and market value, the dividend rate (DPR) has an inverse impact on firms' fiscal performance, meanwhile the decision of dividend payment (DDP) has diverse effects on business firm's functioning.

v. Conclusions and Recommendations

Based on the results of the research above, information technology can be seen that the Vietnamese firms offering quite low dividend rate, an average amount of ten per cent. This depression dividend rate, in one hand, testify that firms are retaining turn a profit for operation and time to come investment. Every bit a consequence, some shareholders believe on time to come prospect so that they continue investing their coin into the firms. All the same, the low dividend, on the other hand leads to the decrease of market expectation to the firms' hereafter evolution.

The high divergence value (16.3%), the wide variance range of dividend rate (0 to 214 per cent) may reverberate the lack of systematic and reasonable dividend policy in Vietnamese listed firms. Firms may subjectively offering a high dividend rate or high cash dividend for the year in which they want to mobilize capital without taking into consideration the effect of such policies on the firms' financial performance, either the accounting-based value or market place-based value.

Based on the research results, the paper proposes the following instructive suggestions:

First, firms should choose and apply the economical model for dividend policies, including dividend charge per unit, decision of dividend payment. Model of dividend policy should be stable, long-term, strategic, and not be affected by immediate influence of firms' managers. Past doing that, the firms may command the cashflow and the required capital structure to attain the best financial functioning.

Second, firms' dividend policies should embed investment policy and financing policy for each stage in house life cycle. For example, in introduction and growth stages, firms should have low dividend rate but in the maturity period, where loftier profit and cash available, the dividend should be high.

Third, it is evidenced that dividend policy also depend on diverse factors. Therefore, firms should accept into account the factors like country characteristic, development period, and on agency cost of debt. These suggestions take been evidenced by several scholars (for case, Brockman and Unlu 2009) or state civilisation (Zheng and Ashraf 2022).

Fouth, firms need to realize that the decision of dividend payment (DDP) has a negative impact on firms' financial performance, and dividend rate impact positively to firms' performance. Thus, firms should construct progressive strategy of dividend payout rate, with 1 steady rate and some additional payments for special circumstances.

And concluding but non least, firms should clearly communicate to shareholders about the tradeoff between high dividend payout rate and performance, so that shareholders will willingly accept the low dividend rate, retaining profit as capital for future evolution.

Inquiry on the bear on of dividend policies on the fiscal performance of Vietnamese listed enterprises evidence that the dividend rate and decision of dividend payment have an effect on firms' financial performance, measured by ROA, ROE, and Tobin's Q in different ways. Based on the findings, we besides suggest some instructive recommendations for firms, including a more appropriate model of dividend policies, keeping depression dividend rate, and clear declaration of dividend payment. These might be useful for listed firms, regulators, investors, and others in making investment decisions for firms.

Notwithstanding, the inquiry model may all the same contain some limitations. 1 of this is related to low R-square in the model. Information technology ways that the paper may have not uncovered many other factors related to dividend policies that directly or indirectly touch on the firm's functioning. In addition, the paper has not taken into account the effect of fourth dimension, industry, firm's historic period, etc. We believe that those potential drawbacks may be the gap for farther research in the futurity.

Author Contributions

Conceptualization: C.D.P., A.H.N. Methodology: C.D.P. Software: T.5.T. Validation: H.T.N. Formal Assay: T.T.T. Investigation: T.V.T. Data curation: N.T.D., T.T.T. Writing original typhoon grooming: T.T.T. Writing, Review and Editing: C.D.P. Supervision: C.D.P. Final Acquisition: A.H.North., H.T.N. All authors take read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Argument

The study was conducted according to the guidelines of the Declaration of Helsinki, and approved by the Institutional Review Lath.

Informed Consent Argument

Informed consent was obtained from all subjects involved in the written report.

Data Availability Statement

Information used for this report is collected from audited fiscal statements of Vietnamese firms which are list in the stock market of Vietnam.

Acknowledgments

This inquiry is funded by the National Economics University (NEU), Vietnam. The authors thank anonymous reviewers for their contributions and the NEU for supporting this enquiry.

Conflicts of Involvement

The authors declare no conflict of involvement.

References

- Ali, Adnan, Farzand Ali Jan, and Maryam Atta. 2022. The impact of dividend policy on house performance under loftier or low leverage: Show from Islamic republic of pakistan. Periodical of Direction Information 2: 16–24. [Google Scholar] [CrossRef]

- Amidu, Mohammed. 2007. How does dividend policy impact the functioning of the firm on the Ghana Stock Substitution? Investment Management and Financial Innovations 4: 103–12. [Google Scholar]

- Amidu, Mohammed, and Joshua Abor. 2006. Determinants of dividend payout ratios in Republic of ghana. The Journal of Run a risk Finance seven: 136–45. [Google Scholar] [CrossRef]

- Bhattacharya, Sudipto. 1979. Imperfect data, dividend policy, and the bird in the manus fallacy. The Bong Journal of Economics ten: 259–lxx. [Google Scholar] [CrossRef]

- Brockman, Paul, and Emre Unlu. 2009. Dividend policy, creditor rights, and the bureau costs of debt. Journal of Financial Economics 92: 276–99. [Google Scholar] [CrossRef]

- Danila, Nevi, Noor Azizan, and Zaheer Ahmez. 2022. Growth opportunities, capital structure and dividend policy in an emerging market: Indonesia case study. The Journal of Asian Finance, Economics, and Business 7: 1–8. [Google Scholar] [CrossRef]

- Dogan, Mesut, and Yusuf Topal. 2022. The Influence of Dividend Payments on Visitor Performance: The Case of Istanbul Stock Exchange (BIST). European Periodical of Concern and Management 6: 189–97. [Google Scholar]

- Donaldson, Gordon. 1961. Corporate Debt Capacity: A Study of Corporate Debt Policy and the Determination of Corporate Debt Capacity. Boston: Partition of Inquiry, Graduate School of Business organisation Administration, Harvard University. [Google Scholar]

- Easterbrook, Frank H. 1984. Two agency-cost explanations of dividends. The American Economic Review 74: 650–59. [Google Scholar] [CrossRef]

- Frankfurter, George M., and Bob G. Forest. 2002. Dividend policy theories and their empirical test. International Review of Financial Analysis 11: 111–38. [Google Scholar] [CrossRef]

- Gill, Amarjit, Nahum Biger, and Rajendra Tibrewala. 2010. Determinants of Dividend Payout Ratios: Show from United States. The Open Business organization Journal three: 8–14. [Google Scholar] [CrossRef]

- Glen, Jack D., Yannis Karmokolias, Robert Miller, and Sanjay Shah. 1995. Dividend Policy and Behavior in Emerging Markets: To Pay or Not to Pay. International Finance Corporation Discussion Paper. No. IFD 26*IFC Working Paper Series; Washington, DC: World Bank Group, Available online: http://documents.worldbank.org/curated/en/325441468741588836/Dividend-policy-and-behavior-in-emerging-markets-to-pay-or-not-to-pay (accessed on 30 March 2022).

- Gordon, Myron J. 1963. Optimal investment and financing policy. The Journal of Finance 18: 264–72. [Google Scholar] [CrossRef]

- Hoang, T., and Due north. G. Due north. Chu. 2022. Applied Statistics in Socio-Economic Enquiry. Hanoi: Statistical Publisher. [Google Scholar]

- Jensen, Michael C., and William H. Meckling. 1976. Theory of the firm: Managerial behavior, agency costs, and buying structure. The Periodical of Financial Economics iii: 305–60. [Google Scholar] [CrossRef]

- Khan, Mula Nazar, Babar Nadeem, Fahad Islam, Muhammad Salman, and Hafiz Muhammad Ikram Sarwar Gill. 2022. Impact of dividend policy on firm performance: An Empirical Evidence From Pakistan Stock Exchange. American Periodical of Economics, Finance and Direction 2: 16–25. [Google Scholar]

- Khan, Kamran, Houda Chakir Lamrani, and Shah Khalid. 2022. The impact of dividend policy on business firm performance: A case written report of the industrial sector. Risk Governance & Control: Financial Markets & Institutions 9: 23–31. [Google Scholar] [CrossRef]

- Kim, Taekyu, and Injoong Kim. 2022. The influence of credit scores on dividend policy: Evidence from the Korean market place. The Journal of Asian Finance, Economics, and Business 7: 33–42. [Google Scholar] [CrossRef]

- Litzenberger, Robert H., and Krishna Ramaswamy. 1982. The effects of dividends on common stock prices tax effects or information furnishings. Journal of Finance 37: 429–43. [Google Scholar] [CrossRef]

- One thousand'rabet, Rachid, and Wiame Boujjat. 2022. The human relationship between dividend payments and house performance: A report of listed companies in Morocco. European Scientific Journal 12: 469–82. [Google Scholar] [CrossRef]

- Michaely, Roni, and Franklin Allen. 2002. Payout policy. SSRN Journal 1: 56–112. [Google Scholar] [CrossRef]

- Miller, Jon. 1980. Controlling and organizational effectiveness: Participation and perceptions. Sociology of Piece of work and Occupations vii: 55–79. [Google Scholar] [CrossRef]

- Miller, Merton H., and Franco Modigliani. 1961. Dividend policy, growth, and the valuation of shares. Journal of Business 34: 411–33. [Google Scholar] [CrossRef]

- Murekefu, Chiliad. T., and P. O. Ouma. 2022. The human relationship betwixt dividend payout and business firm performance. European Scientific Periodical 8: 199–215. [Google Scholar] [CrossRef]

- Myers, Stewart C., and Nicholas S. Majluf. 1984. Corporate financing and investment decisions when firms accept information that investors exercise not have. The Journal of Financial Economics 13: 187–221. [Google Scholar] [CrossRef]

- Onanjiri, Richard, and Thomas Korankye. 2022. Dividend payout and performance of quoted manufacturing firms in Republic of ghana. Research Journal of Finance and Accounting 5: 37–42. [Google Scholar]

- Shefrin, Hersh One thousand., and Meir Statman. 1984. Explaining investor preference for cash dividends. Periodical of Fiscal Economics 13: 253–82. [Google Scholar] [CrossRef]

- Spence, Michael. 1973. Chore market signaling. The Quarterly Journal of Economics 87: 355–74. [Google Scholar] [CrossRef]

- Tabachnick, Barbara Thousand., and Linda South. Fidell. 1996. Using Multivariate Statistics, 6th ed. London: Pearson. [Google Scholar]

- Tran, P. L., D. H. Le, and M. T. Tran. 2022. Furnishings of dividend policies on the financial performance of listed manufacturing firms in the Vietnam stock market (Vietnamese version). Journal of Economics and Evolution 218: 34–41. [Google Scholar]

- Velnampy, T., P. Nimalthasan, and G. Kalaiarasi. 2022. Dividend policy and house performance: Evidence from the manufacturing companies listed on the Colombo Stock Commutation. Global Journal of Management and Business Research xiv: 1–7. [Google Scholar]

- Vijayakumaran, Ratnam, and Nagajeyakumarn Atchyuthan. 2022. Cash Holdings and Corporate Performance: Evidence from Sri Lanka. International Journal of Accounting & Business concern Finance ane: 1–eleven. Available online: https://www.researchgate.net/profile/Ratnam-Vijayakumaran/publication/319290974 (accessed on 31 March 2022).

- Zheng, Changjun, and Badar Nadeem Ashraf. 2022. National culture and dividend policy: International testify from banking. Journal of Behavioral and Experimental Finance three: 22–40. [Google Scholar] [CrossRef]

Figure 1. The proposed inquiry model.

Effigy 1. The proposed research model.

Table one. Statistical description of the research model.

Tabular array 1. Statistical description of the enquiry model.

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| ROE | 5400 | 0.140 | 0.1624 | −1.750 | 2.930 |

| ROA | 5400 | 0.069 | 0.087 | −0.900 | 0.810 |

| TobinQ | 5400 | 0.612 | 0.722 | 0.010 | seven.260 |

| Size | 5400 | 27.019 | 1.495 | 21.150 | 33.630 |

| Growth | 5400 | fourteen.890 | 64.606 | −100.000 | 967.15 |

| Lev | 5400 | 50.590 | 22.030 | 0.350 | 203.060 |

| DPR | 5400 | 10.459 | xiii.296 | 0.000 | 214.000 |

| DDP | 5400 | 0.614 | 0.487 | 0.000 | 1.000 |

Table ii. Correlation matrix between independent variables.

Table two. Correlation matrix between contained variables.

| Size | Growth | Lev | DPR | DDP | |

|---|---|---|---|---|---|

| Size | 1.000 | ||||

| Growth | 0.065 | i.000 | |||

| Lev | 0.299 | 0.026 | one.000 | ||

| DPR | 0.034 | −0.039 | −0.161 | 1.000 | |

| DDP | 0.028 | −0.053 | −0.070 | 0.624 | 1.000 |

Table 3. Result for multicollinearity phenomenon.

Tabular array 3. Result for multicollinearity miracle.

| Variable | VIF | 1/VIF |

|---|---|---|

| DPR | one.68 | 0.593976 |

| DDP | 1.64 | 0.609223 |

| Lev | i.14 | 0.879604 |

| Size | 1.11 | 0.899836 |

| Growth | ane.01 | 0.992749 |

| Mean VIF | 1.32 |

Table iv. Regression results for iii dependent variables.

Table 4. Regression results for three dependent variables.

| Indicators | ROA | ROE | TobinQ | |

|---|---|---|---|---|

| DPR | Coefficient | 0.0008 | 0.0015 | −0.0021 |

| t-value | −4.84 | half-dozen.77 | −5.86 | |

| Sig. level | 0.000 | 0.000 | 0.000 | |

| DDP | Coefficient | −0.0085 | −0.0183 | 0.0189 |

| t-value | −3.48 | −3.16 | one.93 | |

| Sig. level | 0.001 | 0.002 | 0.053 | |

| Size | Coefficient | −0.0080 | −0.0323 | −0.0985 |

| t-value | −iv.84 | −8.29 | −15.01 | |

| Sig. level | 0.000 | 0.000 | 0.000 | |

| Growth | Coefficient | 0.0002 | 0.0004 | −0.0001 |

| t-value | 15.15 | 13.96 | −2.23 | |

| Sig. level | 0.000 | 0.000 | 0.026 | |

| Leverage | Coefficient | −0.0014 | 0.0001 | −0.0082 |

| t-value | −17.28 | 0.080 | −26.44 | |

| Sig. level | 0.000 | 0.938 | 0.000 | |

| Con. | Coefficient | 0.3460 | 1.001 | three.704 |

| t-value | vii.97 | 9.71 | 21.33 | |

| Sig. level | 0.000 | 0.000 | 0.000 | |

| Model | F-statistic | 133.12 | threescore.21 | 250.37 |

| p-value (F-statistic) | 0.000 | 0.000 | 0.000 | |

| R-squared | 0.2217 | 0.0574 | 0.1364 | |

| Publisher'south Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and atmospheric condition of the Artistic Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Which Of The Following Is Not A Way That A Firm Can Increase Itsã¢â‚¬â€¹ Dividend,

Source: https://www.mdpi.com/1911-8074/14/8/353/htm

Posted by: venturahowell.blogspot.com

0 Response to "Which Of The Following Is Not A Way That A Firm Can Increase Itsã¢â‚¬â€¹ Dividend"

Post a Comment